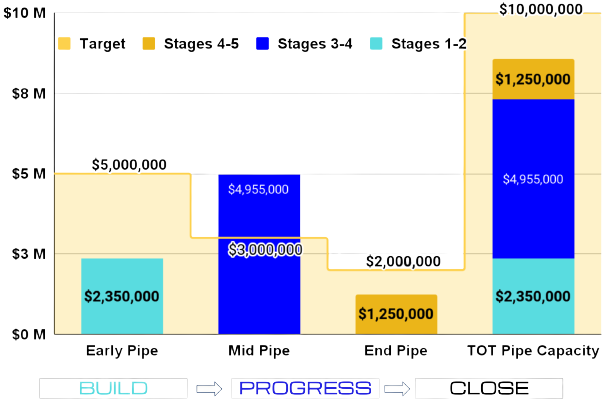

Metric 2: Capacity by Buckets

{color=#FFFFFF, opacity=100, rgba=rgba(255, 255, 255, 1), rgb=rgb(255, 255, 255), hex=#FFFFFF, css=#FFFFFF}

This metric helps answer the question - will reps hit targets each quarter or will they blink?

Sales reps have a natural tendency to focus mostly on those imminent deals that are about to close (rightly so), and therefore can have a tendency to neglect temporarily, or for long periods of time, other deals in the pipe, or even worse the ability to replenish pipeline. Grouping the pipeline staging into three buckets classified as ‘Build’, ‘Progress’, and ‘Close’ allows for easy KPI monitoring of each of those sections of the pipe to be able to solicit the amount and type of activity a rep should periodically perform to replenish any depleting buckets, or progress any overloaded buckets. Doing so, this metric approach can support the development of a rep's success consistency. The more a rep develops a diversified pipeline capacity, and has cued up deals at every stage, the more likely that rep will close on a regular basis, making it a win-win for both him/herself and the company as a whole.