Making GTM Teams More Efficient, Effective and Effortless

In this episode, Evan Randall talks about his three-pronged approach to measuring the health of a revenue team and the set of interrelated metrics that he uses to track it.

Stop reacting to churn. Start predicting it. Download the 2025 Guide to Churn Forecasting

Evan Randall, SVP of Worldwide GTM Strategy and Operations at Teradata, brings over 20 years of experience in handling a broad range of responsibilities across sales, GTM strategy and operations.

The metrics discussed:

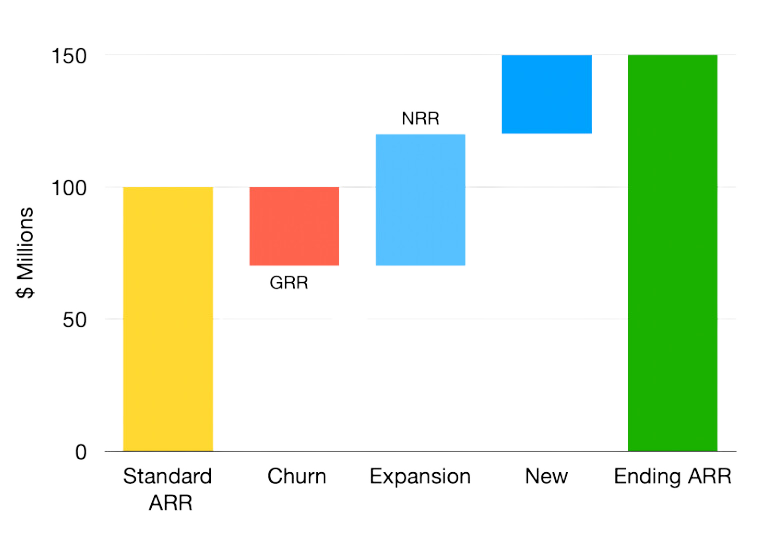

- ARR Health: Visual representation of the positive and negative influences on your annual recurring revenue stream.

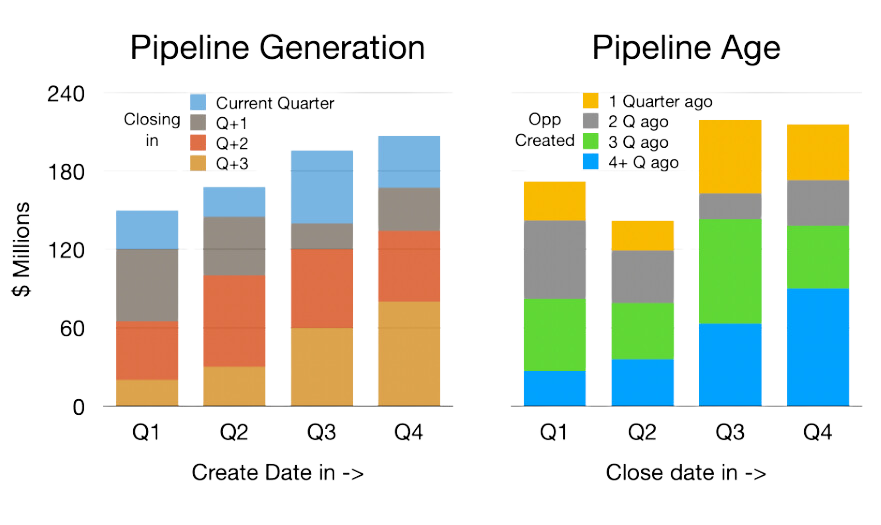

- Pipeline Health: Visual representation of the generation, size, shape, and age of the company’s pipeline.

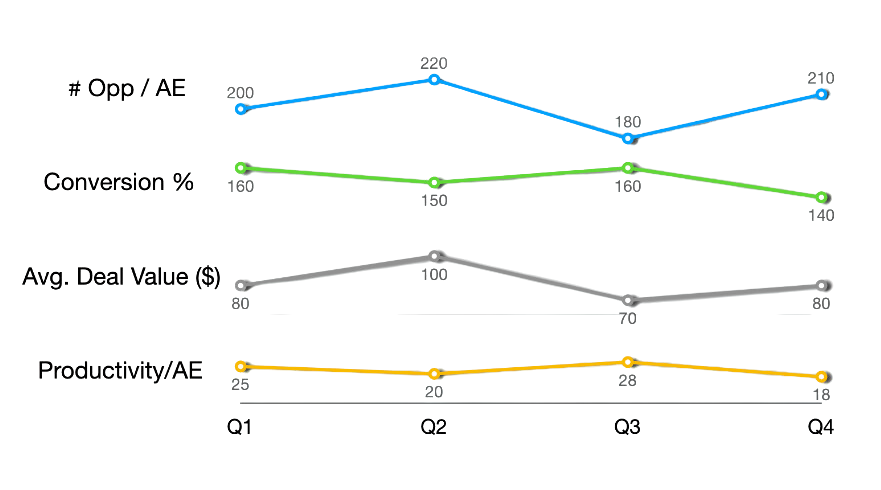

- GTM Health: Visual representation of the true productivity or cost efficiency of the go-to-market organization

Objective data is the key to productive conversations

Objective data acts as the backbone for all decision-making processes. Evan Randall emphasizes that without data, every statement is merely an opinion. Leveraging objective data ensures that strategies and decisions are grounded in fact, making them more effective and reliable.

Tailoring the sales process can significantly boost productivity

By analyzing where opportunities stagnate or fall through in the sales process, organizations can implement targeted strategies to avoid the same. Effective enablement, such as training account executives to articulate value, can increase conversion rates, deal sizes, and reduce sales cycle times.

Regular rebalancing in operations optimizes efficiency

Evan suggests that operations should be continuously evaluated and rebalanced in line with the company's goals and available resources. By engaging sales leadership in these rebalancing conversations, operations can remain agile, efficient, and aligned with the company's strategic direction.

{color=#FFFFFF, opacity=100, rgba=rgba(255, 255, 255, 1), rgb=rgb(255, 255, 255), hex=#FFFFFF, css=#FFFFFF}

The ARR Health Metric, as expounded by Evan Randall, is a vital metric that offers insights into a company's recurring revenue health by focusing on customer growth, net retention, and momentum. It transcends mere annual earnings, spotlighting the nuanced interplay of churn, expansions, and new business. Such insights allow firms to preemptively pivot strategies based on current and predicted trajectories.

By juxtaposing different periods, the metric provides a condensed view of financial growth or decline. Essentially, the ARR Health Metric distills complex revenue data, ensuring businesses remain proactive in optimizing their recurring revenue streams amidst market challenges.

{color=#FFFFFF, opacity=100, rgba=rgba(255, 255, 255, 1), rgb=rgb(255, 255, 255), hex=#FFFFFF, css=#FFFFFF}

Pipeline Health is an essential metric to understand the vitality and potential of a company's sales prospects. This metric doesn't just focus on what's in the pipeline, but it intricately evaluates how deals move through it, accounting for factors like stalled deals, duration within stages, and aging. Such scrutiny helps organizations identify inefficiencies, pinpoint blockages, and course-correct in real-time.

Through a methodical analysis using the Pipeline Health Metric, businesses can unearth actionable insights, like the optimal time frames for deal progressions or stages needing enhancements.

{color=#FFFFFF, opacity=100, rgba=rgba(255, 255, 255, 1), rgb=rgb(255, 255, 255), hex=#FFFFFF, css=#FFFFFF}

The Go-To-Market (GTM) Health Metric offers a comprehensive view of how the go-to-market team performs in real-time. It dives deeper than high-level corporate metrics, zooming into areas such as conversion rates, the number of deals handled concurrently, average deal size, and sales cycles.

By optimizing these facets, a company can significantly enhance its productivity, ensuring that the GTM strategy is both efficient and effective.

Matt Durazzani: Welcome everybody again to one of our Revenue Mavericks, um, podcast. And we are very excited to have Evan Randall with us.

... I'm Matt Durazzani, I'm your host. And I'm a revenue maverick advisor. For the audience, I would love to introduce you for a second to Evan.

He is the senior Vice president of Worldwide Go-To-Market Strategy and Operations at Teradata. For over two decades, Evan has brought impact to many Fortune 500 companies.

He's experienced bridges across all aspects of revenue operations. Something very unique about Evan is that he feels very blessed that during his career he has been exposed to companies in hypergrowth, mode, which, uh, bring their own challenges, and then eventually they went IPO as well as worked into

multi billion dollar companies where things are much more complex and broad in both focus and needs. So as you can imagine, his insight is very well sought by executives that he supports as well as other leaders in the industry. And we are very excited to hear from him today. So welcome Evan.

Evan Randall: Thanks so much, Matt.

It's good to be here. Appreciate it

Matt Durazzani: Evan so as we were talking earlier, um, today's program, we would like to hear from you on how you look at the revenue, uh, engine holistically? And I know you have prepared, um, three metrics that you would like to share with the audience that have provided an impact or made a difference in the way you like to manage revenue in the organization.

So without any further ado, we'll love to turn it over to you and allow you to share what you have prepared for us today.

Evan Randall: That sounds great. I appreciate it, Matt. I appreciate the opportunity to come talk about this and talk about metrics and I'm gonna expound a lot on, on this stuff and, um, you know, I'm looking forward to digging deep with you and going into more questions.

So let's, uh, let's get rocking

Evan Randall: So, Before I get started, you know, I think the first thing I would talk about is how I think about revenue operations, go-to-market operations in general. And it, it is that we are the stewards of Salesforce time and productivity, right?

We're here to make sure that they're being efficient, effective, and they're doing it in the most effortless way. And have you ever talked to, uh, anyone that worked for me They'll, they'll always say, well, Evan always talks about E-cubed and has nothing to do with the first letter of my name.

It's that what we are here to do is we're here to provide efficient, effective, and effortless experiences to our customers, our partners, and our sales teams, right? So truly drive productivity, and I'm gonna talk a little bit today about when I come and look in an organization and really want to experience and understand the health

of the organization from different dimensions, these are the things I look at. So you, even though Matt said there's three metrics, I'd say there's three health scores that I look at that include a few more than, a few more than one metric. But it's still important to me when I'm looking at an organization to really focus on what I'm gonna do and what are my team's gonna do to make it truly E-cubed.

And one other thing just for the mission that I think about from my teams, that when they're divided into these three main components of strategy, operations, and and enablement is, and our mission statement is, we deliver accelerated time to value and successful business outcomes for our customers and partners by increasing our go-to-market productivity through effective strategic planning, actionable insights, world-class enablement and operational excellence. So you can probably, uh, figure out the structure of the team that I normally, uh, work with, but it's, uh, it's a broad scope and I, and, and everyone who's a revenue operations leader, go to market operations leader, sales operations leader, stay in this discipline. It is awesome, and it just provides you with an challenges on a regular basis. And I personally experience every human emotion daily. So let's just jump right into it.

Matt Durazzani: Evan, I have a good question about that.

I can totally sense the energy and the excitement of how to bring these things together, right? Uh, maybe for people in the audience that are maybe trying to think and building these business and maybe think about, uh, earlier stage companies that are may be in hyper growth or just, uh, you know, a little more traditional pace, as well as potentially companies that are larger that have not yet invested into a good revenue operation team.

Can you give us a sense of what type of teams usually report under you? Um, and, uh, so, so we get a sense of what type of roles should be included in to support these three elements you discussed.

Evan Randall: Yes. So, um, like I said, I break it into three main sections. We've got strategy, enablement and operations. Strategy I usually break down into strategy, planning and incentives. Some people say strategy, planning and compensation. Uh, but I like calling it, the spy team, S P I- strategy, planning and Incentives. And this team, they focus on what is the best way we're gonna deploy our investments each year through the annual planning process. So looking at our segmentation, building out propensity to buy models, uh, developing compensation plans, quota design methodologies. So there, it, it can be broken into a few different types of roles. Uh, like people that come out of, you know, the, the, the big five, uh, consulting firms to think kind of strategically how are we gonna approach the market uh, from a segmentation perspective. Also, what type of roles do we need for each parts of the market? How many AEs, how many, sales, engineers, things of that nature. Industry experts or specialists or, uh, CSMs really thinking about what sort of model, do we need to get the biggest return out of every dollar that we spend?

Okay, so that's the strategy, planning, incentives, uh, organization and group of people. Then you get into enablement and uh, I was talking with Matt earlier, I think the word enablement is used too much. It has become nebulous because. The product team can enable sales, right? Cuz they create products that the salespeople can sell.

So everyone enables sales. What I like to divide it into is two main pieces, readiness and acceleration. Readiness is all about onboarding, right? So you have instructional designers and trainers who know how to put together journeys for people to go through so that they can digest and be certified that they know what they're talking about at the end of an onboarding or training journey, right?

So that's readiness. Getting everyone ready to get into the field to sell. So instructional designers, trainers, project managers, those sorts of people sit in that organization. That's also organization that drives things like sales kickoff. Right. Or virtual enablement calls, um, help drive the, uh, we, we have a, uh, micro-learning platform that allows people to learn every five minutes on their cell phone, right?

And build out that curriculum. Then acceleration is all about providing a sales rep with the tools um, to help them ensure that they're extremely effective and productive. So I'll give you an example, right, like account planning. We can develop a great account planning process, but if it's not truly enabled and driven into the organization so they know how to utilize it, we're not being effective. we help people accelerate the processes that they already have. And another thing would be like sales plays, working very closely with the marketing organization once they've designed campaigns and things of that nature to build out the scripts and the narratives, et cetera.

So that's enablement. And then finally, operations. This is where all the global business process owners live. Like if you're, if you own the sales process or the lean management process, or the opportunity management process, or the rhythm of the business that's forecasting in QBR's, all of that needs to be thought about in this organization and, um, developed as processes. And this is also where I have people that analyze the business, right? Analyze the rhythm of the business. This is where a deal management team would sit, or a proposal development center would sit, or maybe business value engineering, right? What are we doing to execute on our plan from an operations perspective across the entire continuum of, uh, of the go-to-market or revenue organization?

So all the process, technology and insights come out the operations team and then all the people that are, that are actually executing on a lot of these processes where we need operations. So that's, that's how I think about it. And, you know, depending on the size of company, you know, you'll have, you may have a generalist that does strategy and operations together in one, right?

Matt Durazzani: That's right.

Evan Randall: A small team. And then when you get into the, you know, the size of maybe over a hundred people, then you can get a lot more specialists in each one of these role types.

Matt Durazzani: Well, thank you for sharing that. I think that's very important for a lot of people. Uh, you know, that's, uh, that's an error that a number of them have reached out to ask.

You know, where, where should I put people, how to break it down. I think the way you explained it, um, it's a very thoughtful way to, to really provide order and ownership without having people crossing over each other step in each other's door, but really owning very specific pieces that they compliment each other and, and they collaborate, uh, in a way that it's a lot more agile and effective versus owning it all.

Right. So thanks for doing that.

Evan Randall: Totally.

Matt Durazzani: Um, anything else you wanna say about this before we jump into your first metric?

Evan Randall: I don't think so. Let's go right in.

Matt Durazzani: Let's do it then.

Evan Randall: whenever I come to a new company or I'm looking at how the year went, I always want to look at a few different things.

The first thing, especially for companies that run on annual recurring revenue is the health of that part of the business. And my favorite way to look at it is in this waterfall chart here, and let me explain it first before I, um, go into what sort of decisions I make or, or the benefits of it. So this is looking at the starting ARR annual recurring revenue at the beginning of the year, and then what did you add or subtract to that to get to the end? Pretty simple, right? But there's some really important pieces, of information that you can glean from looking at something like this. So starting with your standard ARR, the first thing you wanna understand, who did we lose?

What did we erode? Like and, and, and, uh, what customers did we lose? Did we just erode business? Did we keep the customer and erode a little bit of it? How much should we churn out of the business out of our ARR? And this actually turns into your gross retention rate. So that is like not taking into account any new customers or any expansions, just your current book of business.

How much did we retain? And it can also include if you're able to erode discounts or increase, your business with consumer price index increases, that all goes into your gross renewal rate. So that really gets you a good feel for how are you maintaining your current dollars cuz it is a lot cheaper to keep $1 of your customer than it is to go find a new one. And especially in, in, uh, today's times a lot easier to maintain dollars. So that's your gross, uh, retention, uh, rate. And then when you add an expansion, so this is taking your current customers and adding to their current ARR.

So if you have a customer that is a million dollars ARR and you turn that customer into a 1.2 million customer ARR you got $200,000 of expansion. This is extremely important too, because you want to continue to grow your annual annuity in ARR by adding dollars into, uh, your current customers.

So your NRR, your net retention rate is all your current renewable dollars that you renewed plus any expansion. A healthy NRR should probably be in the 110 to 120%. And if you're a really badass company, you're over 130%. So this is where you really need to be. And just to jump back to GRR really quickly, from a, a benchmark for that, If you're mainly selling an enterprise, you definitely need to be in the 90% land cuz it's a lot harder for enterprises to churn once they add a software in.

And then SMB, mid-market could probably be in the 80% range cuz there's there, it's a lot easier for them to move around. Did you have a question, Matt?

Matt Durazzani: No, no. This is, this is really good. Um, um, yeah. Actually one of the things that you're talking about, uh, you know, the waterfall is something that a lot of people look at, right?

Uh, and I think in some ways it can be considered standard. What I think it makes the difference is the way you're thinking about it is, um, these are all independent units. Um, I love that you're actually sharing best, uh, uh, percentage practices where people should be expecting, right? Because someone can look at this report and say, well, is it good or is it bad, right?

And immediately, you know, where do I gauge what is the benchmark in the industry? So I like and appreciate you shared, uh, in particular when it comes to NRR 110 to 120 is maybe a good average. And of course, if you're really, really good, you're well beyond that one. Right? Uh, especially if you can accelerate it.

I also thought it was very interesting that you brought up one thing that, uh, we're hearing a lot these days, which is, uh, you said it's a lot cheaper to keep a dollar from a customer than finding a new one. It's very, very true. So, as of 2023, do you have any, um, I don't know if it's a strategy or any inputs that you could say, hey, everyone out there, if you are trying to accelerate that piece, here's one way that in 2023 can make a difference for you to maybe expand these accounts. Any, any recommendations there?

Evan Randall: So strategically we're absolutely looking at this because again, it's, it, it, it's cheaper to maintain a dollar. It's cheaper to get a dollar from a current customer than it is to go get a new dollar from a new customer. Right. So, that's right.

Um, and also a lot of customers or prospects don't wanna spend in kind of this environment right and again, it's a lot easier if you have a platform or you have a, uh, an offering that has, there's more white space with your current customers that they can expand there. our strategy right now is to, um, help our customers I see that it is more cost effective to remain with the Terradata platform than expand maybe go get all these little point solutions or even consolidate onto us, right? So grab your other data warehouse platforms or data lakes and bring them into one cuz you'll save money overall, right?

So this is the opportunity from a recession standpoint, is to help them see how they can save money and also extend your NRR at the same time. So that's one of the things we're looking at to continue to, to drive a little bit more NRR's, is use the, the macroeconomic conditions to sell a aggregation play, so to speak. That's just one of many we're looking at.

Matt Durazzani: So we extend the value of the current product, right? And you haven't used everything. Uh, maybe the adoption is not as, as strong as it can be. Right. So really looking at how are they using the product and identify additional values that they can add by staying there without looking for pieces of solutions that are external, but could be solved with the current environment. So educate them, uh, all those things. It sounds like it's what you're saying.

Evan Randall: You're right on that and I think it's pretty obvious from the start, like you say, it is very basic, but it's just such a wealth of information on where you can spend your time and how to prioritize your investments because, you know, you may be losing dollars from a gross, uh, retention rate perspective, but if you're killing it on, on the expansion side, maybe that's where your investment should go.

If you've got the flywheel running and you're still over 130%, you're gonna wanna figure out why you're losing dollars on the GRR side, but you your money where you're gonna get the biggest return, right? Reduce cost of customer acquisition or acquisition of a dollar and increase your LTV.

If your GRR is going down, your LTV is coming down, right?

Matt Durazzani: Right.

Evan Randall: So you gotta, you have to be thinking about it from all different angles. this is why I love this view, is I can ask so many questions and also use it as an objective uh, illustration when I go talk to executive leadership or sales leadership on why I think we should do certain things.

Matt Durazzani: Right.

Evan Randall: And, and I hope that that articulates why I look at this ARR health view.

Matt Durazzani: One, one last question, this one, because I think, uh, you're bringing up, uh, another very good point. Um, you mentioned that every time you come into a new company, you like to look at the health of revenue by using this one, right? In an operational cadence to you as a leader, how often do you feel it's important that you, you do a little bit of a, let's call it, come to Jesus with this one. How often do you really look at deeply? Is it quarterly? Is it monthly? Is it every week? Uh, what do you feel is a good pattern for management?

Evan Randall: I'm gonna say it depends. And what it really depends on is the velocity of your business. If you have a sales cycle that's 18 months long, you know this won't change too often, right? It you'll, you'll, you'll get your big ebbs and flows during that period of time. So I think it really depends on how many transactions you're pumping through, how long your sales cycle is, um, I mean, generally like the productivity of your business. So if, if I were to put an average for the, for the waterfall across like all the businesses I've been that have a subscription model, uh, looking at this quarterly, uh, felt like the right frequency to do it.

But again, if you've got a very high transactional business with, with short sales cycles, um, And maybe you don't, you don't do annual contracts and you do like monthly. they can leave monthly. You're probably gonna wanna look at it a lot more frequently. But if it's an enterprise with multi-year contracts and no one's leaving and, and it, it's not moving around that much, then you can extend it out.

As with any metric, right? Anything you're looking at, you just have to understand is it changing enough for us to look at it and, and Those other dimensions, uh, would help me decide how often we should look at something like this.

Matt Durazzani: Well said. We're, we're ready for metric number two, thank you for sharing.

Evan Randall: Galactic metric number two. So pipeline, the lifeblood of the organization right. So, um, after looking at how, okay, how is, how is the organization executing at, at the ARR level and how are we losing business? Are we gaining business and understanding where we're making those investments?

Pipeline is the next piece of that, right? Because pipeline kind of feeds into how, how are we doing ARR and, and I think it's a, it's an easy corollary to, uh, what we just looked at. I look at a couple things in a couple different cohorts here. So let me. Uh, explain the visual representation first. So the first thing I look at is pipeline generation.

So how are we generating our pipeline each quarter, right? is our pipeline generation going up? Is it going down? Um, not necessarily looking at conversion rate right yet, right? We just wanna say like, okay, How are we generating and then where are we putting that generation?

Are we putting a one quarter out? Are we generating two quarters in advance? Where's it going? Right? Because if we are generating a ton of pipeline in Q1 but it's all for Q4, that's not necessarily gonna help you for this year. Okay? So, um, that's pipeline generation. Pipeline aging is the cohort, is the close date.

So a, do we have enough coverage of our targets? Right? So once you understand your conversion rates and you can determine like, okay, we have enough pipeline being generated for our conversion rates, but then do we have enough coverage in the specific quarter? So, on pipeline age, this is, this is the cohort of how much pipeline you have in q1, q2, q3, and if you have enough coverage and then the colors are, how old is it?

So really you start, should start looking at anything that is above your average sales cycle. So if you have an average sales cycle of two quarters, Then everything in green and blue would be suspect. And you really need to do a better job of qualifying that pipeline and understanding if it's real.

Cause this is one area where a lot of companies start to determine what their real conversion rate is based on lost and won, but if you have perpetual garbage just flowing in your pipeline quarter over quarter, uh, year over year, you're not gonna be able to use that true conversion rate that you've developed to get a good answer on if you have enough coverage, cuz it might look like you always have great coverage.

and then you can also push on your organization to, hey, we need to either qualify this in, or qualify it out, and be a little bit more rigorous on that in the, in the business. So again, do you have enough pipeline generated? And then do you have enough legitimate qualified and fresh pipeline to hit your targets?

Those are the two dimensions I look at, at, you know, more of the galactic level, as I say, to get a feel for where do we need to drill a little bit more to see what the issue is from a pipeline health perspective.

Matt Durazzani: I think that's always a good advice to look at these two in in combination.

Um, one of the ways that, uh, I like to of often think about is that that's, there's always free money in a sense, in a pipeline aging view, right? In the sense of here's money that you don't have to spend in the previous slides you talked about, when you look at that waterfall approach, , one of the business question you had there is, you know, where should we spend the next budget?

Where should we focus our resources and time? I think this is one of those that it's free. Its money that's already been spent and doesn't have to be regenerated. It just needs to be revived. And so, uh, going back to your previous slide, uh, maybe a question is if you see that there's quite a bit of pipe, at least as demonstrated from this, uh, uh, dummy data, um, scenario for a second.

Uh, And you start talking to your enablement team, especially the part that is, uh, not just readiness, but the acceleration part that you talked about. Uh, what type of conversation or actions normally come out when, when you see that there's a lot of ARR that is stuck, that it's old, that hasn't closed, that hasn't progressed, but it also hasn't been disqualified yet.

So gimme a sense of how this data gives, uh, some type of actions in your business.

Evan Randall: So if we are seeing things stagnating at a specific point, right? So we look at the aging, we've see it's stagnated as specific stage of the sales process, right? That, that's kind of one step further. Then I go to my enablement organization and we can determine like what strategically do we want to do to help bust through that stage.

So let's say, um, we have a lot of, uh, we have a lot of opportunities get to at a certain stage. Of, of, uh, let's say configuration or quoting. Everyone's got a different name for that stage, and when we get to that stage, we, we start to see customers pull back or they always choose the smallest option. Like, we're not doing a good job at, at articulating value and they're like, eh, you know what? We're just gonna dip our tone of water. And we al always see our average, size of opportunity shrinking when we get to that stage. So, for instance, I might have the enablement team work closely with the business value engineering team is what processes can we put in place to proactively target our larger deals, to put in place a, discussion and a narrative for our account executives to have with the customer around business values. So prep each individual AE for each of those deals. And it's easier to send done. So for bigger deals like where I work, uh, we can do that for almost every single one. And you'd have to pick and choose and prioritize other ones, but providing a process and, um, a way to accelerate the conversation with the customer rather than the sales rep kind of fumbling around and not being able to articulate the value to meet the customer's success criteria or expected requirements, whatever it may be. So that may, that's one example of uh, depending on where, where we see the issue, we would go try to implement a process that can help, you know, increase conversion rates, decrease sales cycle times, uh, increase deal size.

Uh, any one of those, those things should help increase productivity and conversion of the pipeline.

Matt Durazzani: That's a great example. Thank you.

Evan Randall: Absolutely. All right. Last but not least, Is the, uh, go to market health. So galactic metric number three, that includes four other metrics. Um, so this one I like to look at to explain like how the go to market team is executing, cuz the waterfall is more corporate level wide. There's so many things that go into that when you really want to zoom in to the X number of people you have that are field facing, it's looking at your productivity, go to market health. And I break, productivity into a few different things. I break it into, um, conversion rate, so, uh, how many deals you can run at one time, whether you win or lose them, And then finally, average deal size.

And then the corollary to those three is sales cycle. So in order to make sure that you're driving the right level of productivity, you need to make sure those three that I talked about, the number of at bats or deals that you're running, your conversion rates, and then your average deal size are maximized in every way, shape or form.

And what's great about going and looking at this health over time and seeing how you're trending, you can start making decisions on, uh, what we need to do to make those changes. So, uh, the top one here, you can see the number of opportunities per AE on average, what our current conversion percentage is, 160% conversion, that's a hell of a conversion.

But you know, in reality, you'd probably have something, you know, anywhere from like a 20 to 40% conversion rate.

Uh, so that's conversion rate. Average deal size I think that's pretty obvious, like what are we doing to continue to grow deals? It uh, an example would be if your average deal size is going down, what sort of campaigns we can put in place, offers, packaging, anything to grow deals in the moment, right? So that you can start to drive that average deal size up.

Cuz what's so amazing about productivity and these three dimensions, Is that if you work on all three, it's mul, multiplicative. I wish it was geometric or exponential, but it's multiplicative, um, of, of, of extra productivity that you get.

Um, because if everything else stays the same and you improve your conversion rates with better enablement, right? Like an example would be, um, let's say your conversion rates are going down. And I'm a true believer that, uh, enablement and readiness really is a strong driver of conversion because you can make like, let's, let's take, uh, your quintessential SDR sales development rep. They need to make 80 to a hundred phone calls a day. you can give 'em all the best tools in the world where it calls it's spoof numbers, it calls the area codes at the exact right time, that when people pick up the most.

But if you get somebody on the phone and the SDR has no idea what they're talking about, what they're saying, they're not being effective. So there's efficiency with the tool and then effectiveness with the readiness. So I'm, I'm a true believer of kind of, you have to hit both of those dimensions. And what this metric allows you to do is say, okay, hey, we're not being very effective in conversion.

What is it? Oh, we've got the best tools in the face of the planet. These guys auto call a hundred calls a day. Well, let's start listening to their calls. Let's start reading the transcripts. And they may be calling, um, a hospital and have no idea about the, the things that a, uh, hospital administrator cares about.

But when you start enabling them, and you can put in a program and give them just in time information, or it may be something, even the opportunity like, Hey, these are the four bullets that a hospital administrator cares about. And when you start speaking like that, you start speaking with credibility and those are the sorts of things that can improve conversion rates as an example.

So, um, those are just, I, I just wanted to give a couple examples of. You know how you can improve it, but if you see it going the wrong direction, you can take action. And for this one, I, again, I look at this quarterly, uh, to see if we need to adjust anything. And then, and then if you see an issue, this is where you start exploring your data more, right? if you look back in my career, early at Tableau software, it was all about, you know, we help people see and understand our data. And being able to explore and visualize just gives you the power of a, asking so many more questions so you can make good decisions on where you're going to invest our very small amount of dollars that we have in operations to get the biggest productivity return.

And I feel like this, view along with the other two just gives you the ability to make really great investment decisions.

Matt Durazzani: Well, this is, this is awesome and I appreciate everything that you shared today, you can clearly see that, um, you know, you're looking for a very few set of metrics that can give you a very high level health across all the years of business..

So thanks for sharing all of this today. Um, one, one last question before we let you go is, Think about those, um, leaders that today are facing maybe, uh, business reduction, whether it could be a sales leader, like a CRO, it could be even a CEO of a company.

Um, and maybe they had, uh, faced some layoffs or, uh, situations where there's no longer, a fully staffed, um, operational team to support. And of course there's gonna be challenges they're gonna face real soon in the future right because they don't have that supporting element right. What recommendation would you give to those leaders right now in early 2023 to think in terms of why they should reconsider or consider, uh, developing these people for very specific reasons and what, what advice would you give them?

Evan Randall: one of my favorite sayings is, without data, you're just another person with an opinion. So all of these conversations should be based on objective data.

Okay. And what I've seen work, especially in downturns like this, like, like my team wasn't even immune to this. You know, like everybody made changes to the organizations over the last three weeks or last few months. Um, What I try to clearly articulate is what my team is here to do, right? I'm always talking about our vision, our mission, and our objectives, and our roadmap and our service portfolio.

I, I clearly articulate like, these are the things we do for this company. These are the headcounts that I have that do these things for this company. And if we had to make changes, then I go back to the sales leadership team and say, okay, I'm gonna have to make these many changes. This is my recommended rebalancing of what I'm gonna be able to provide.

Do you agree? Do you not agree? Like these are the programs we're gonna no longer do. This is the the personnel support you're no longer going to have. These are the tools we're gonna have to deprecate that you used to have, cuz we can't afford them anymore. What would, would you prefer us to move the chess pieces around?

I put this together based on my expertise and my experience, but I want your feedback as a sales leadership team, and that is the point when you can start having the conversation that you just talked about, you need to have that view because then a CRO and the other sales leaderships can say crap either none of your options were work Evan, and we need to go back to the CFO or we're gonna need to, maybe we don't need as many sales engineers or or sales specialists or whatever, right? maybe we need to actually invest in operations because we see the return that each one of these areas gets. Or you can all hands in the middle. Yep. We agree with it. Or we wanna make these tweaks to your rebalancing hands in the middle. And it gives you something to stand out as an operations leader when they come back six months later and say like, why aren't you supporting me in this way? You can just open up the document that you all agreed to six months ago and like, this is how we rebalanced.

Like maybe we should have another rebalancing conversation and keep it completely like objective based on the data and based on your discussions. I'm, I'm big on that bidirectional agreement with sales leadership cuz it's so easy to get into that, that, uh, emotional cycle of the sales like what operations doesn't support me,

I can't hit the number. Like they, I don't know what happened to them. They, they can't, they just don't deliver.

Matt Durazzani: That's right. Very well said. Well, Evan, Always a pleasure. Thank you so much again for preparing yourself and taking time out of your business schedule to talk to the community. Um, this program will be made available to you guys very soon.

Uh, we appreciate everybody that has watched and attended this. And if you wish to connect with Evan, I'm sure he's available via LinkedIn, feel free to connect with him and, and, uh, pick his brain and, and see what else, uh, uh, what other nuggets you can gain from working with Evan. But thank you again and uh, we wish you all have one fantastic day.

Evan Randall: Thanks, Matt. Thanks everyone.

Matt Durazzani: Welcome everybody again to one of our Revenue Mavericks, um, podcast. And we are very excited to have Evan Randall with us.

I'm Matt Durazzani, I'm your host. And I'm a revenue maverick advisor. For the audience, I would love to introduce you for a second to Evan.

He is the senior Vice president of Worldwide Go-To-Market Strategy and Operations at Teradata. For over two decades, Evan has brought impact to many Fortune 500 companies.

He's experienced bridges across all aspects of revenue operations. Something very unique about Evan is that he feels very blessed that during his career he has been exposed to companies in hypergrowth, mode, which, uh, bring their own challenges, and then eventually they went IPO as well as worked into

multi billion dollar companies where things are much more complex and broad in both focus and needs. So as you can imagine, his insight is very well sought by executives that he supports as well as other leaders in the industry. And we are very excited to hear from him today. So welcome Evan.

Evan Randall: Thanks so much, Matt.

It's good to be here. Appreciate it

Matt Durazzani: Evan so as we were talking earlier, um, today's program, we would like to hear from you on how you look at the revenue, uh, engine holistically? And I know you have prepared, um, three metrics that you would like to share with the audience that have provided an impact or made a difference in the way you like to manage revenue in the organization.

So without any further ado, we'll love to turn it over to you and allow you to share what you have prepared for us today.

Evan Randall: That sounds great. I appreciate it, Matt. I appreciate the opportunity to come talk about this and talk about metrics and I'm gonna expound a lot on, on this stuff and, um, you know, I'm looking forward to digging deep with you and going into more questions.

So let's, uh, let's get rocking

Evan Randall: So, Before I get started, you know, I think the first thing I would talk about is how I think about revenue operations, go-to-market operations in general. And it, it is that we are the stewards of Salesforce time and productivity, right?

We're here to make sure that they're being efficient, effective, and they're doing it in the most effortless way. And have you ever talked to, uh, anyone that worked for me They'll, they'll always say, well, Evan always talks about E-cubed and has nothing to do with the first letter of my name.

It's that what we are here to do is we're here to provide efficient, effective, and effortless experiences to our customers, our partners, and our sales teams, right? So truly drive productivity, and I'm gonna talk a little bit today about when I come and look in an organization and really want to experience and understand the health

of the organization from different dimensions, these are the things I look at. So you, even though Matt said there's three metrics, I'd say there's three health scores that I look at that include a few more than, a few more than one metric. But it's still important to me when I'm looking at an organization to really focus on what I'm gonna do and what are my team's gonna do to make it truly E-cubed.

And one other thing just for the mission that I think about from my teams, that when they're divided into these three main components of strategy, operations, and and enablement is, and our mission statement is, we deliver accelerated time to value and successful business outcomes for our customers and partners by increasing our go-to-market productivity through effective strategic planning, actionable insights, world-class enablement and operational excellence. So you can probably, uh, figure out the structure of the team that I normally, uh, work with, but it's, uh, it's a broad scope and I, and, and everyone who's a revenue operations leader, go to market operations leader, sales operations leader, stay in this discipline. It is awesome, and it just provides you with an challenges on a regular basis. And I personally experience every human emotion daily. So let's just jump right into it.

Matt Durazzani: Evan, I have a good question about that.

I can totally sense the energy and the excitement of how to bring these things together, right? Uh, maybe for people in the audience that are maybe trying to think and building these business and maybe think about, uh, earlier stage companies that are may be in hyper growth or just, uh, you know, a little more traditional pace, as well as potentially companies that are larger that have not yet invested into a good revenue operation team.

Can you give us a sense of what type of teams usually report under you? Um, and, uh, so, so we get a sense of what type of roles should be included in to support these three elements you discussed.

Evan Randall: Yes. So, um, like I said, I break it into three main sections. We've got strategy, enablement and operations. Strategy I usually break down into strategy, planning and incentives. Some people say strategy, planning and compensation. Uh, but I like calling it, the spy team, S P I- strategy, planning and Incentives. And this team, they focus on what is the best way we're gonna deploy our investments each year through the annual planning process. So looking at our segmentation, building out propensity to buy models, uh, developing compensation plans, quota design methodologies. So there, it, it can be broken into a few different types of roles. Uh, like people that come out of, you know, the, the, the big five, uh, consulting firms to think kind of strategically how are we gonna approach the market uh, from a segmentation perspective. Also, what type of roles do we need for each parts of the market? How many AEs, how many, sales, engineers, things of that nature. Industry experts or specialists or, uh, CSMs really thinking about what sort of model, do we need to get the biggest return out of every dollar that we spend?

Okay, so that's the strategy, planning, incentives, uh, organization and group of people. Then you get into enablement and uh, I was talking with Matt earlier, I think the word enablement is used too much. It has become nebulous because. The product team can enable sales, right? Cuz they create products that the salespeople can sell.

So everyone enables sales. What I like to divide it into is two main pieces, readiness and acceleration. Readiness is all about onboarding, right? So you have instructional designers and trainers who know how to put together journeys for people to go through so that they can digest and be certified that they know what they're talking about at the end of an onboarding or training journey, right?

So that's readiness. Getting everyone ready to get into the field to sell. So instructional designers, trainers, project managers, those sorts of people sit in that organization. That's also organization that drives things like sales kickoff. Right. Or virtual enablement calls, um, help drive the, uh, we, we have a, uh, micro-learning platform that allows people to learn every five minutes on their cell phone, right?

And build out that curriculum. Then acceleration is all about providing a sales rep with the tools um, to help them ensure that they're extremely effective and productive. So I'll give you an example, right, like account planning. We can develop a great account planning process, but if it's not truly enabled and driven into the organization so they know how to utilize it, we're not being effective. we help people accelerate the processes that they already have. And another thing would be like sales plays, working very closely with the marketing organization once they've designed campaigns and things of that nature to build out the scripts and the narratives, et cetera.

So that's enablement. And then finally, operations. This is where all the global business process owners live. Like if you're, if you own the sales process or the lean management process, or the opportunity management process, or the rhythm of the business that's forecasting in QBR's, all of that needs to be thought about in this organization and, um, developed as processes. And this is also where I have people that analyze the business, right? Analyze the rhythm of the business. This is where a deal management team would sit, or a proposal development center would sit, or maybe business value engineering, right? What are we doing to execute on our plan from an operations perspective across the entire continuum of, uh, of the go-to-market or revenue organization?

So all the process, technology and insights come out the operations team and then all the people that are, that are actually executing on a lot of these processes where we need operations. So that's, that's how I think about it. And, you know, depending on the size of company, you know, you'll have, you may have a generalist that does strategy and operations together in one, right?

Matt Durazzani: That's right.

Evan Randall: A small team. And then when you get into the, you know, the size of maybe over a hundred people, then you can get a lot more specialists in each one of these role types.

Matt Durazzani: Well, thank you for sharing that. I think that's very important for a lot of people. Uh, you know, that's, uh, that's an error that a number of them have reached out to ask.

You know, where, where should I put people, how to break it down. I think the way you explained it, um, it's a very thoughtful way to, to really provide order and ownership without having people crossing over each other step in each other's door, but really owning very specific pieces that they compliment each other and, and they collaborate, uh, in a way that it's a lot more agile and effective versus owning it all.

Right. So thanks for doing that.

Evan Randall: Totally.

Matt Durazzani: Um, anything else you wanna say about this before we jump into your first metric?

Evan Randall: I don't think so. Let's go right in.

Matt Durazzani: Let's do it then.

Evan Randall: whenever I come to a new company or I'm looking at how the year went, I always want to look at a few different things.

The first thing, especially for companies that run on annual recurring revenue is the health of that part of the business. And my favorite way to look at it is in this waterfall chart here, and let me explain it first before I, um, go into what sort of decisions I make or, or the benefits of it. So this is looking at the starting ARR annual recurring revenue at the beginning of the year, and then what did you add or subtract to that to get to the end? Pretty simple, right? But there's some really important pieces, of information that you can glean from looking at something like this. So starting with your standard ARR, the first thing you wanna understand, who did we lose?

What did we erode? Like and, and, and, uh, what customers did we lose? Did we just erode business? Did we keep the customer and erode a little bit of it? How much should we churn out of the business out of our ARR? And this actually turns into your gross retention rate. So that is like not taking into account any new customers or any expansions, just your current book of business.

How much did we retain? And it can also include if you're able to erode discounts or increase, your business with consumer price index increases, that all goes into your gross renewal rate. So that really gets you a good feel for how are you maintaining your current dollars cuz it is a lot cheaper to keep $1 of your customer than it is to go find a new one. And especially in, in, uh, today's times a lot easier to maintain dollars. So that's your gross, uh, retention, uh, rate. And then when you add an expansion, so this is taking your current customers and adding to their current ARR.

So if you have a customer that is a million dollars ARR and you turn that customer into a 1.2 million customer ARR you got $200,000 of expansion. This is extremely important too, because you want to continue to grow your annual annuity in ARR by adding dollars into, uh, your current customers.

So your NRR, your net retention rate is all your current renewable dollars that you renewed plus any expansion. A healthy NRR should probably be in the 110 to 120%. And if you're a really badass company, you're over 130%. So this is where you really need to be. And just to jump back to GRR really quickly, from a, a benchmark for that, If you're mainly selling an enterprise, you definitely need to be in the 90% land cuz it's a lot harder for enterprises to churn once they add a software in.

And then SMB, mid-market could probably be in the 80% range cuz there's there, it's a lot easier for them to move around. Did you have a question, Matt?

Matt Durazzani: No, no. This is, this is really good. Um, um, yeah. Actually one of the things that you're talking about, uh, you know, the waterfall is something that a lot of people look at, right?

Uh, and I think in some ways it can be considered standard. What I think it makes the difference is the way you're thinking about it is, um, these are all independent units. Um, I love that you're actually sharing best, uh, uh, percentage practices where people should be expecting, right? Because someone can look at this report and say, well, is it good or is it bad, right?

And immediately, you know, where do I gauge what is the benchmark in the industry? So I like and appreciate you shared, uh, in particular when it comes to NRR 110 to 120 is maybe a good average. And of course, if you're really, really good, you're well beyond that one. Right? Uh, especially if you can accelerate it.

I also thought it was very interesting that you brought up one thing that, uh, we're hearing a lot these days, which is, uh, you said it's a lot cheaper to keep a dollar from a customer than finding a new one. It's very, very true. So, as of 2023, do you have any, um, I don't know if it's a strategy or any inputs that you could say, hey, everyone out there, if you are trying to accelerate that piece, here's one way that in 2023 can make a difference for you to maybe expand these accounts. Any, any recommendations there?

Evan Randall: So strategically we're absolutely looking at this because again, it's, it, it, it's cheaper to maintain a dollar. It's cheaper to get a dollar from a current customer than it is to go get a new dollar from a new customer. Right. So, that's right.

Um, and also a lot of customers or prospects don't wanna spend in kind of this environment right and again, it's a lot easier if you have a platform or you have a, uh, an offering that has, there's more white space with your current customers that they can expand there. our strategy right now is to, um, help our customers I see that it is more cost effective to remain with the Terradata platform than expand maybe go get all these little point solutions or even consolidate onto us, right? So grab your other data warehouse platforms or data lakes and bring them into one cuz you'll save money overall, right?

So this is the opportunity from a recession standpoint, is to help them see how they can save money and also extend your NRR at the same time. So that's one of the things we're looking at to continue to, to drive a little bit more NRR's, is use the, the macroeconomic conditions to sell a aggregation play, so to speak. That's just one of many we're looking at.

Matt Durazzani: So we extend the value of the current product, right? And you haven't used everything. Uh, maybe the adoption is not as, as strong as it can be. Right. So really looking at how are they using the product and identify additional values that they can add by staying there without looking for pieces of solutions that are external, but could be solved with the current environment. So educate them, uh, all those things. It sounds like it's what you're saying.

Evan Randall: You're right on that and I think it's pretty obvious from the start, like you say, it is very basic, but it's just such a wealth of information on where you can spend your time and how to prioritize your investments because, you know, you may be losing dollars from a gross, uh, retention rate perspective, but if you're killing it on, on the expansion side, maybe that's where your investment should go.

If you've got the flywheel running and you're still over 130%, you're gonna wanna figure out why you're losing dollars on the GRR side, but you your money where you're gonna get the biggest return, right? Reduce cost of customer acquisition or acquisition of a dollar and increase your LTV.

If your GRR is going down, your LTV is coming down, right?

Matt Durazzani: Right.

Evan Randall: So you gotta, you have to be thinking about it from all different angles. this is why I love this view, is I can ask so many questions and also use it as an objective uh, illustration when I go talk to executive leadership or sales leadership on why I think we should do certain things.

Matt Durazzani: Right.

Evan Randall: And, and I hope that that articulates why I look at this ARR health view.

Matt Durazzani: One, one last question, this one, because I think, uh, you're bringing up, uh, another very good point. Um, you mentioned that every time you come into a new company, you like to look at the health of revenue by using this one, right? In an operational cadence to you as a leader, how often do you feel it's important that you, you do a little bit of a, let's call it, come to Jesus with this one. How often do you really look at deeply? Is it quarterly? Is it monthly? Is it every week? Uh, what do you feel is a good pattern for management?

Evan Randall: I'm gonna say it depends. And what it really depends on is the velocity of your business. If you have a sales cycle that's 18 months long, you know this won't change too often, right? It you'll, you'll, you'll get your big ebbs and flows during that period of time. So I think it really depends on how many transactions you're pumping through, how long your sales cycle is, um, I mean, generally like the productivity of your business. So if, if I were to put an average for the, for the waterfall across like all the businesses I've been that have a subscription model, uh, looking at this quarterly, uh, felt like the right frequency to do it.

But again, if you've got a very high transactional business with, with short sales cycles, um, And maybe you don't, you don't do annual contracts and you do like monthly. they can leave monthly. You're probably gonna wanna look at it a lot more frequently. But if it's an enterprise with multi-year contracts and no one's leaving and, and it, it's not moving around that much, then you can extend it out.

As with any metric, right? Anything you're looking at, you just have to understand is it changing enough for us to look at it and, and Those other dimensions, uh, would help me decide how often we should look at something like this.

Matt Durazzani: Well said. We're, we're ready for metric number two, thank you for sharing.

Evan Randall: Galactic metric number two. So pipeline, the lifeblood of the organization right. So, um, after looking at how, okay, how is, how is the organization executing at, at the ARR level and how are we losing business? Are we gaining business and understanding where we're making those investments?

Pipeline is the next piece of that, right? Because pipeline kind of feeds into how, how are we doing ARR and, and I think it's a, it's an easy corollary to, uh, what we just looked at. I look at a couple things in a couple different cohorts here. So let me. Uh, explain the visual representation first. So the first thing I look at is pipeline generation.

So how are we generating our pipeline each quarter, right? is our pipeline generation going up? Is it going down? Um, not necessarily looking at conversion rate right yet, right? We just wanna say like, okay, How are we generating and then where are we putting that generation?

Are we putting a one quarter out? Are we generating two quarters in advance? Where's it going? Right? Because if we are generating a ton of pipeline in Q1 but it's all for Q4, that's not necessarily gonna help you for this year. Okay? So, um, that's pipeline generation. Pipeline aging is the cohort, is the close date.

So a, do we have enough coverage of our targets? Right? So once you understand your conversion rates and you can determine like, okay, we have enough pipeline being generated for our conversion rates, but then do we have enough coverage in the specific quarter? So, on pipeline age, this is, this is the cohort of how much pipeline you have in q1, q2, q3, and if you have enough coverage and then the colors are, how old is it?

So really you start, should start looking at anything that is above your average sales cycle. So if you have an average sales cycle of two quarters, Then everything in green and blue would be suspect. And you really need to do a better job of qualifying that pipeline and understanding if it's real.

Cause this is one area where a lot of companies start to determine what their real conversion rate is based on lost and won, but if you have perpetual garbage just flowing in your pipeline quarter over quarter, uh, year over year, you're not gonna be able to use that true conversion rate that you've developed to get a good answer on if you have enough coverage, cuz it might look like you always have great coverage.

and then you can also push on your organization to, hey, we need to either qualify this in, or qualify it out, and be a little bit more rigorous on that in the, in the business. So again, do you have enough pipeline generated? And then do you have enough legitimate qualified and fresh pipeline to hit your targets?

Those are the two dimensions I look at, at, you know, more of the galactic level, as I say, to get a feel for where do we need to drill a little bit more to see what the issue is from a pipeline health perspective.

Matt Durazzani: I think that's always a good advice to look at these two in in combination.

Um, one of the ways that, uh, I like to of often think about is that that's, there's always free money in a sense, in a pipeline aging view, right? In the sense of here's money that you don't have to spend in the previous slides you talked about, when you look at that waterfall approach, , one of the business question you had there is, you know, where should we spend the next budget?

Where should we focus our resources and time? I think this is one of those that it's free. Its money that's already been spent and doesn't have to be regenerated. It just needs to be revived. And so, uh, going back to your previous slide, uh, maybe a question is if you see that there's quite a bit of pipe, at least as demonstrated from this, uh, uh, dummy data, um, scenario for a second.

Uh, And you start talking to your enablement team, especially the part that is, uh, not just readiness, but the acceleration part that you talked about. Uh, what type of conversation or actions normally come out when, when you see that there's a lot of ARR that is stuck, that it's old, that hasn't closed, that hasn't progressed, but it also hasn't been disqualified yet.

So gimme a sense of how this data gives, uh, some type of actions in your business.

Evan Randall: So if we are seeing things stagnating at a specific point, right? So we look at the aging, we've see it's stagnated as specific stage of the sales process, right? That, that's kind of one step further. Then I go to my enablement organization and we can determine like what strategically do we want to do to help bust through that stage.

So let's say, um, we have a lot of, uh, we have a lot of opportunities get to at a certain stage. Of, of, uh, let's say configuration or quoting. Everyone's got a different name for that stage, and when we get to that stage, we, we start to see customers pull back or they always choose the smallest option. Like, we're not doing a good job at, at articulating value and they're like, eh, you know what? We're just gonna dip our tone of water. And we al always see our average, size of opportunity shrinking when we get to that stage. So, for instance, I might have the enablement team work closely with the business value engineering team is what processes can we put in place to proactively target our larger deals, to put in place a, discussion and a narrative for our account executives to have with the customer around business values. So prep each individual AE for each of those deals. And it's easier to send done. So for bigger deals like where I work, uh, we can do that for almost every single one. And you'd have to pick and choose and prioritize other ones, but providing a process and, um, a way to accelerate the conversation with the customer rather than the sales rep kind of fumbling around and not being able to articulate the value to meet the customer's success criteria or expected requirements, whatever it may be. So that may, that's one example of uh, depending on where, where we see the issue, we would go try to implement a process that can help, you know, increase conversion rates, decrease sales cycle times, uh, increase deal size.

Uh, any one of those, those things should help increase productivity and conversion of the pipeline.

Matt Durazzani: That's a great example. Thank you.

Evan Randall: Absolutely. All right. Last but not least, Is the, uh, go to market health. So galactic metric number three, that includes four other metrics. Um, so this one I like to look at to explain like how the go to market team is executing, cuz the waterfall is more corporate level wide. There's so many things that go into that when you really want to zoom in to the X number of people you have that are field facing, it's looking at your productivity, go to market health. And I break, productivity into a few different things. I break it into, um, conversion rate, so, uh, how many deals you can run at one time, whether you win or lose them, And then finally, average deal size.

And then the corollary to those three is sales cycle. So in order to make sure that you're driving the right level of productivity, you need to make sure those three that I talked about, the number of at bats or deals that you're running, your conversion rates, and then your average deal size are maximized in every way, shape or form.

And what's great about going and looking at this health over time and seeing how you're trending, you can start making decisions on, uh, what we need to do to make those changes. So, uh, the top one here, you can see the number of opportunities per AE on average, what our current conversion percentage is, 160% conversion, that's a hell of a conversion.

But you know, in reality, you'd probably have something, you know, anywhere from like a 20 to 40% conversion rate.

Uh, so that's conversion rate. Average deal size I think that's pretty obvious, like what are we doing to continue to grow deals? It uh, an example would be if your average deal size is going down, what sort of campaigns we can put in place, offers, packaging, anything to grow deals in the moment, right? So that you can start to drive that average deal size up.

Cuz what's so amazing about productivity and these three dimensions, Is that if you work on all three, it's mul, multiplicative. I wish it was geometric or exponential, but it's multiplicative, um, of, of, of extra productivity that you get.

Um, because if everything else stays the same and you improve your conversion rates with better enablement, right? Like an example would be, um, let's say your conversion rates are going down. And I'm a true believer that, uh, enablement and readiness really is a strong driver of conversion because you can make like, let's, let's take, uh, your quintessential SDR sales development rep. They need to make 80 to a hundred phone calls a day. you can give 'em all the best tools in the world where it calls it's spoof numbers, it calls the area codes at the exact right time, that when people pick up the most.

But if you get somebody on the phone and the SDR has no idea what they're talking about, what they're saying, they're not being effective. So there's efficiency with the tool and then effectiveness with the readiness. So I'm, I'm a true believer of kind of, you have to hit both of those dimensions. And what this metric allows you to do is say, okay, hey, we're not being very effective in conversion.

What is it? Oh, we've got the best tools in the face of the planet. These guys auto call a hundred calls a day. Well, let's start listening to their calls. Let's start reading the transcripts. And they may be calling, um, a hospital and have no idea about the, the things that a, uh, hospital administrator cares about.

But when you start enabling them, and you can put in a program and give them just in time information, or it may be something, even the opportunity like, Hey, these are the four bullets that a hospital administrator cares about. And when you start speaking like that, you start speaking with credibility and those are the sorts of things that can improve conversion rates as an example.

So, um, those are just, I, I just wanted to give a couple examples of. You know how you can improve it, but if you see it going the wrong direction, you can take action. And for this one, I, again, I look at this quarterly, uh, to see if we need to adjust anything. And then, and then if you see an issue, this is where you start exploring your data more, right? if you look back in my career, early at Tableau software, it was all about, you know, we help people see and understand our data. And being able to explore and visualize just gives you the power of a, asking so many more questions so you can make good decisions on where you're going to invest our very small amount of dollars that we have in operations to get the biggest productivity return.

And I feel like this, view along with the other two just gives you the ability to make really great investment decisions.

Matt Durazzani: Well, this is, this is awesome and I appreciate everything that you shared today, you can clearly see that, um, you know, you're looking for a very few set of metrics that can give you a very high level health across all the years of business..

So thanks for sharing all of this today. Um, one, one last question before we let you go is, Think about those, um, leaders that today are facing maybe, uh, business reduction, whether it could be a sales leader, like a CRO, it could be even a CEO of a company.

Um, and maybe they had, uh, faced some layoffs or, uh, situations where there's no longer, a fully staffed, um, operational team to support. And of course there's gonna be challenges they're gonna face real soon in the future right because they don't have that supporting element right. What recommendation would you give to those leaders right now in early 2023 to think in terms of why they should reconsider or consider, uh, developing these people for very specific reasons and what, what advice would you give them?

Evan Randall: one of my favorite sayings is, without data, you're just another person with an opinion. So all of these conversations should be based on objective data.

Okay. And what I've seen work, especially in downturns like this, like, like my team wasn't even immune to this. You know, like everybody made changes to the organizations over the last three weeks or last few months. Um, What I try to clearly articulate is what my team is here to do, right? I'm always talking about our vision, our mission, and our objectives, and our roadmap and our service portfolio.

I, I clearly articulate like, these are the things we do for this company. These are the headcounts that I have that do these things for this company. And if we had to make changes, then I go back to the sales leadership team and say, okay, I'm gonna have to make these many changes. This is my recommended rebalancing of what I'm gonna be able to provide.

Do you agree? Do you not agree? Like these are the programs we're gonna no longer do. This is the the personnel support you're no longer going to have. These are the tools we're gonna have to deprecate that you used to have, cuz we can't afford them anymore. What would, would you prefer us to move the chess pieces around?

I put this together based on my expertise and my experience, but I want your feedback as a sales leadership team, and that is the point when you can start having the conversation that you just talked about, you need to have that view because then a CRO and the other sales leaderships can say crap either none of your options were work Evan, and we need to go back to the CFO or we're gonna need to, maybe we don't need as many sales engineers or or sales specialists or whatever, right? maybe we need to actually invest in operations because we see the return that each one of these areas gets. Or you can all hands in the middle. Yep. We agree with it. Or we wanna make these tweaks to your rebalancing hands in the middle. And it gives you something to stand out as an operations leader when they come back six months later and say like, why aren't you supporting me in this way? You can just open up the document that you all agreed to six months ago and like, this is how we rebalanced.

Like maybe we should have another rebalancing conversation and keep it completely like objective based on the data and based on your discussions. I'm, I'm big on that bidirectional agreement with sales leadership cuz it's so easy to get into that, that, uh, emotional cycle of the sales like what operations doesn't support me,

I can't hit the number. Like they, I don't know what happened to them. They, they can't, they just don't deliver.

Matt Durazzani: That's right. Very well said. Well, Evan, Always a pleasure. Thank you so much again for preparing yourself and taking time out of your business schedule to talk to the community. Um, this program will be made available to you guys very soon.

Uh, we appreciate everybody that has watched and attended this. And if you wish to connect with Evan, I'm sure he's available via LinkedIn, feel free to connect with him and, and, uh, pick his brain and, and see what else, uh, uh, what other nuggets you can gain from working with Evan. But thank you again and uh, we wish you all have one fantastic day.

Evan Randall: Thanks, Matt. Thanks everyone.

Craig Handy

Director RevOps & GTM Strategy

Watch the episode

Evan Randall

Senior VP, GTM Strategy & Ops

Watch the episode

Imran Musaev

VP RevOps

Watch the episode