2024 RevOps Trends Report

{color=#b8c8e6, opacity=100, rgba=rgba(184, 200, 230, 1), rgb=rgb(184, 200, 230), hex=#b8c8e6, css=#b8c8e6}

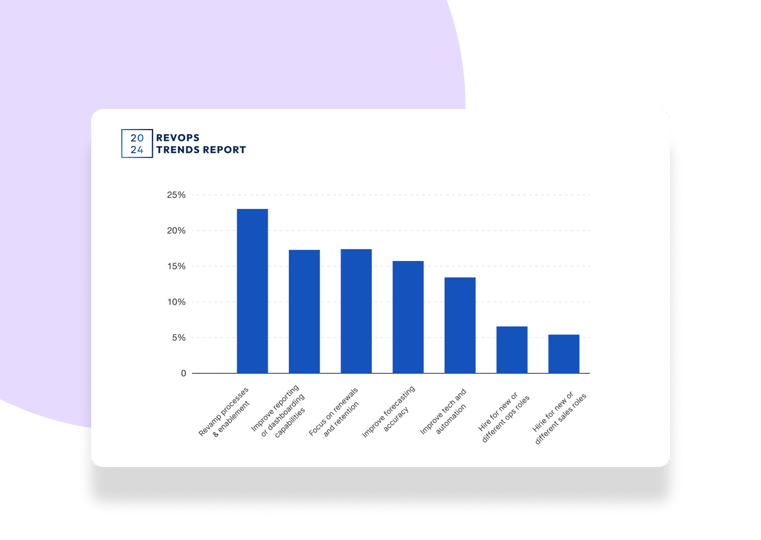

The decades-long era of growth at all costs is over. In response, revenue leaders are building a brand new playbook for 2024. This research aims to offer a glimpse into how the landscape for revenue operations and strategy teams has changed, and, more importantly, what that new playbook will include.