The Revenue Blog /

5 Areas of Examination for a Successful Forecast Review Meeting

5 Areas of Examination for a Successful Forecast Review Meeting

Topics covered in this article

In a previous blog, we covered the 5 tips to running a successful forecasting review meeting. In this blog, we will be focusing on the 5 areas of examination for a successful forecast review meeting in BoostUp.

We all know how important it is to be able to accurately and consistently predict your forecast number. In many organizations, it is one of the most critical metrics for any successful, long-standing organization. However, achieving highly accurate forecasts is part science, part trade, and many processes, practice, and refinement.

A proper forecast review meeting is an opportunity for the entire revenue organization to align to make the biggest business impact. At the highest level, in a forecast call meeting, you will examine:

- How much business is currently closed?

- How are we as a business trending?

- What deals are active and likely to close?

- What committed deals should be moved to the next quarter?

- What best-case deals can be pulled into the current quarter?

- What’s your pipeline health and coverage for next quarter?

Today, we examine the 5 areas of examination for a successful forecast call meeting:

- Step 1: Look at how we are trending and what has changed since the last forecast meeting

- Step 2: View what has been committed, its risk, and what has changed

- Step 3: Dive into engagement, key objections, and associated risk of those committed deals

- Step 4: Focus on committed, best-case deals and swing deals

- Step 5: Look at next-quarter pipeline risk and forecast projections.

Additionally, we have included this short video (has sound) demonstrating how revenue teams use BoostUp to project and call their forecast accurately.

How to Run a Forecast Call in BoostUp

At BoostUp, our objective is to help you go from forecast uncertainty to complete revenue confidence.

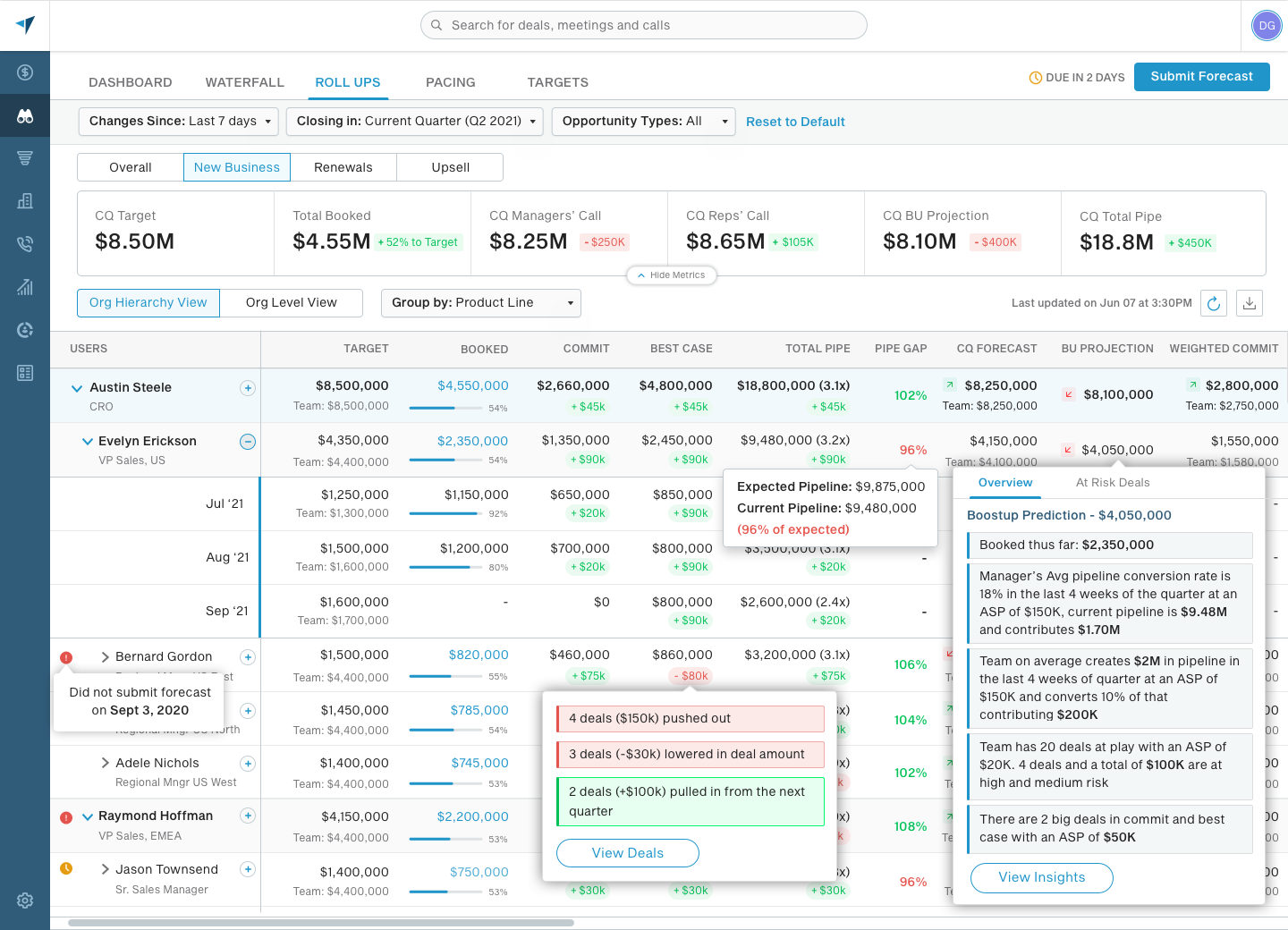

Step 1: Look at how we are trending and what has changed since the last forecast meeting.

In BoostUp, you can navigate to your custom roll-ups page to see how you are trending towards your forecast targets. In this example, we are displaying this information by the sales manager, but this can be easily customized based on your organization’s needs.

You can also see how much revenue is booked by the sales leader and rep, along with how much pipeline is in commit, best-case, and pipeline based on your pipeline coverage targets.

Step 2: View what has been committed, its risk, and what has changed.

Look at your commit deals and see what has changed since the last forecast meeting. We recommend doing this weekly. This will give you a sense if your deals are progressing as they should or are regressing.

Look at your deal’s associated risk score, sort by risk, and see what deals should be removed. This gives you an opportunity to quickly clean up your committed deals and focus on the deals that are progressing, have low risk, and are expected to close.

.png?width=2880&name=boostup_opportunity2@2x%20(4).png)

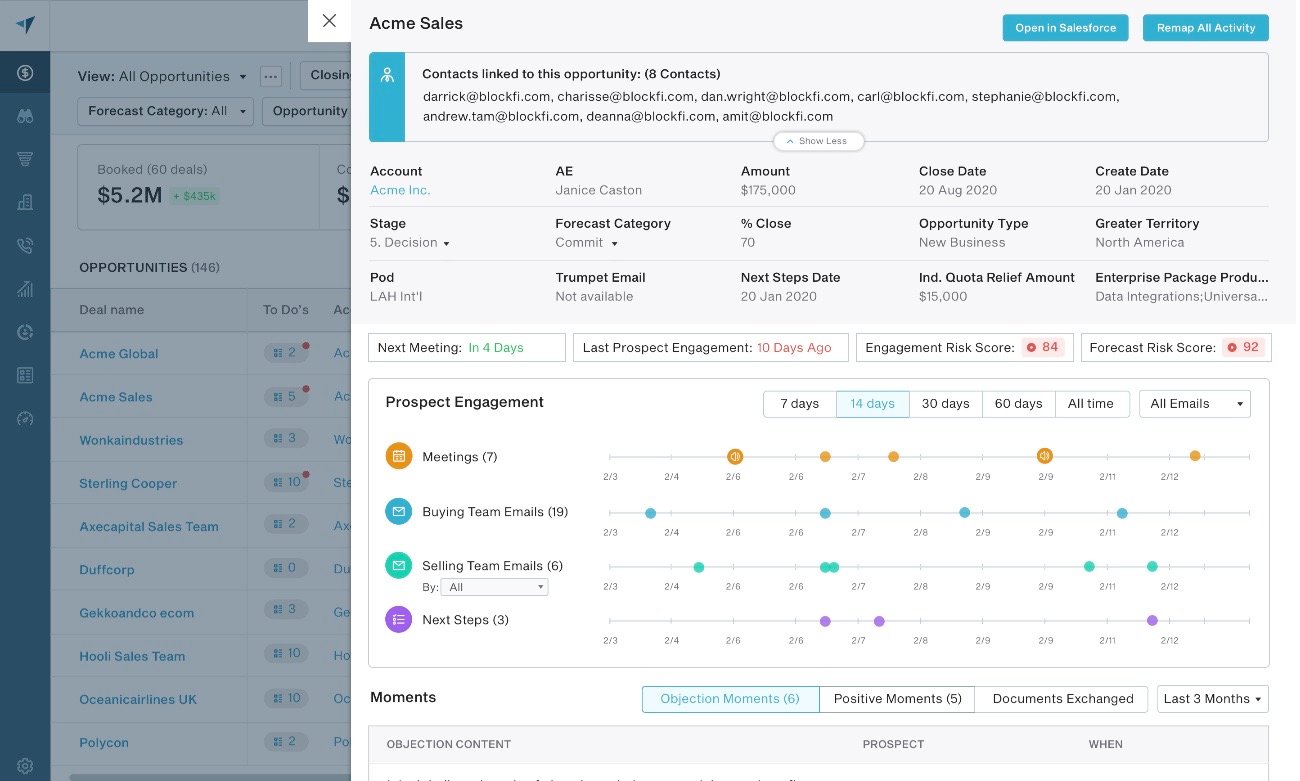

Step 3: Dive into engagement, key objections, and associated risk of those committed deals.

By looking at BoostUp’s deal insights page, we can quickly identify the engagement between the buying and selling team, including all calls and emails. By looking at this activity and associated next steps, we can determine if this deal will likely close and remain in commit or remove it.

Step 4: Focus on committed, best-case deals and swing deals.

After reviewing all your committed deals and cleaning that up, all deals in the commit forecast category have the necessary engagement to close as expected.

Once that’s done, it’s a perfect opportunity to look at the best-case deals and see if we can work to pull those into the quarter. Next, focus on the best-case deals with really good engagement and that have good sentiment and low risk.

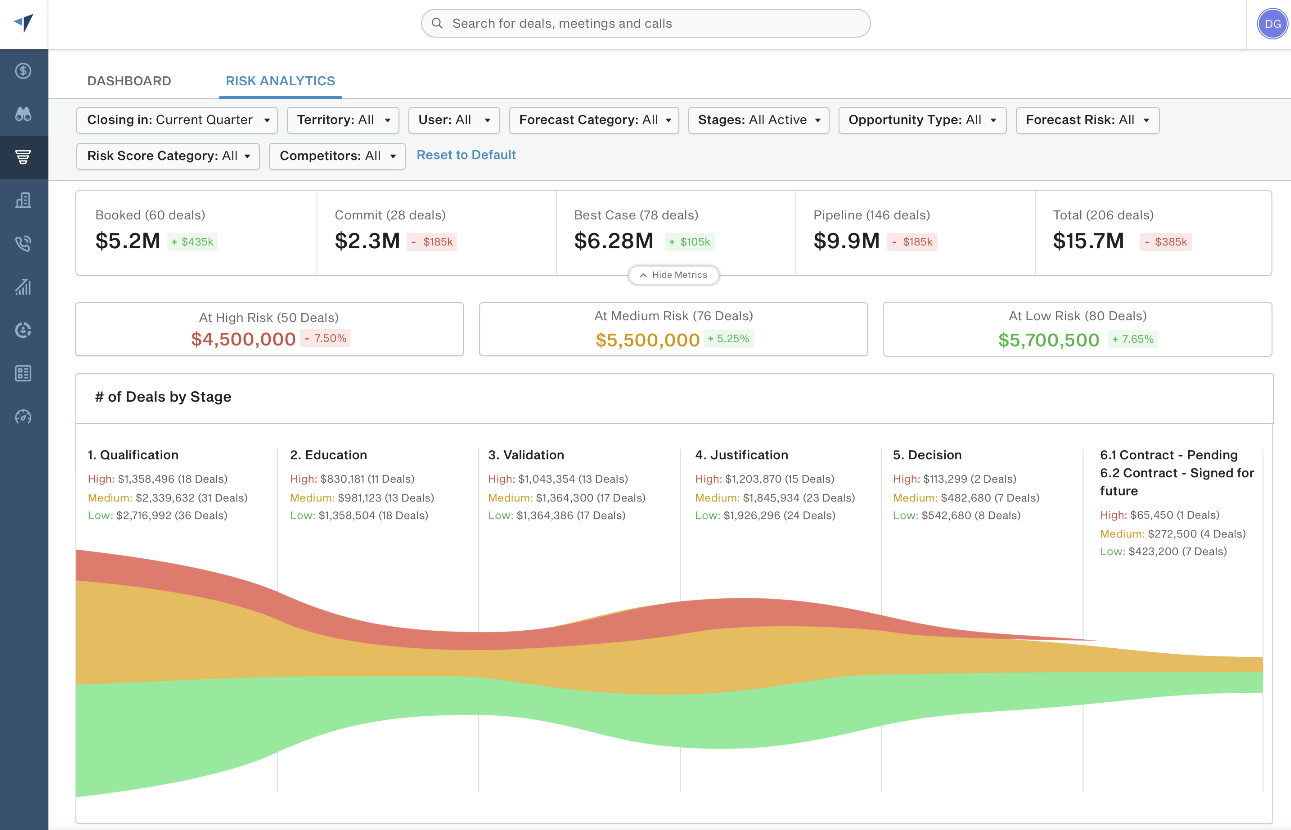

Step 5: Look at next-quarter pipeline risk and forecast projections.

As you review your current forecasted deals, it is important to take a look at the next quarter’s pipeline. Look to see how much pipeline we have, how much is at risk, and our pipeline coverage ratio.

Looking at what stages each deal is in, what has progressed, what has not moved, and what deals are at-risk will give you a good sense of how the next-quarter forecast is shaping up.

How Can BoostUp Help

With BoostUp, empower your revenue team with forecasting designed for repeatable, predictive growth. Powered by AI, BoostUp’s forecasting intelligence solution delivers actionable insights your front-line teams need to hit the coveted 95% forecast accuracy and close more deals faster.

-Photoroom.png)